amazon flex after taxes

One of the simplest ways to save money on gas as an Amazon Flex. With Amazon Flex you work only when you want to.

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

Youre suppose to pay quarterly which I will now dropping 27k nearly all at once will mess up my.

. Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least 600 working for the service within the tax year. Driving for Amazon flex can be a good way to earn supplemental income. As an Amazon Flex DoorDash Uber Eats Grubh.

Lets take a closer look at what this. You can plan your week by reserving blocks in advance or picking them. We know how valuable your time is.

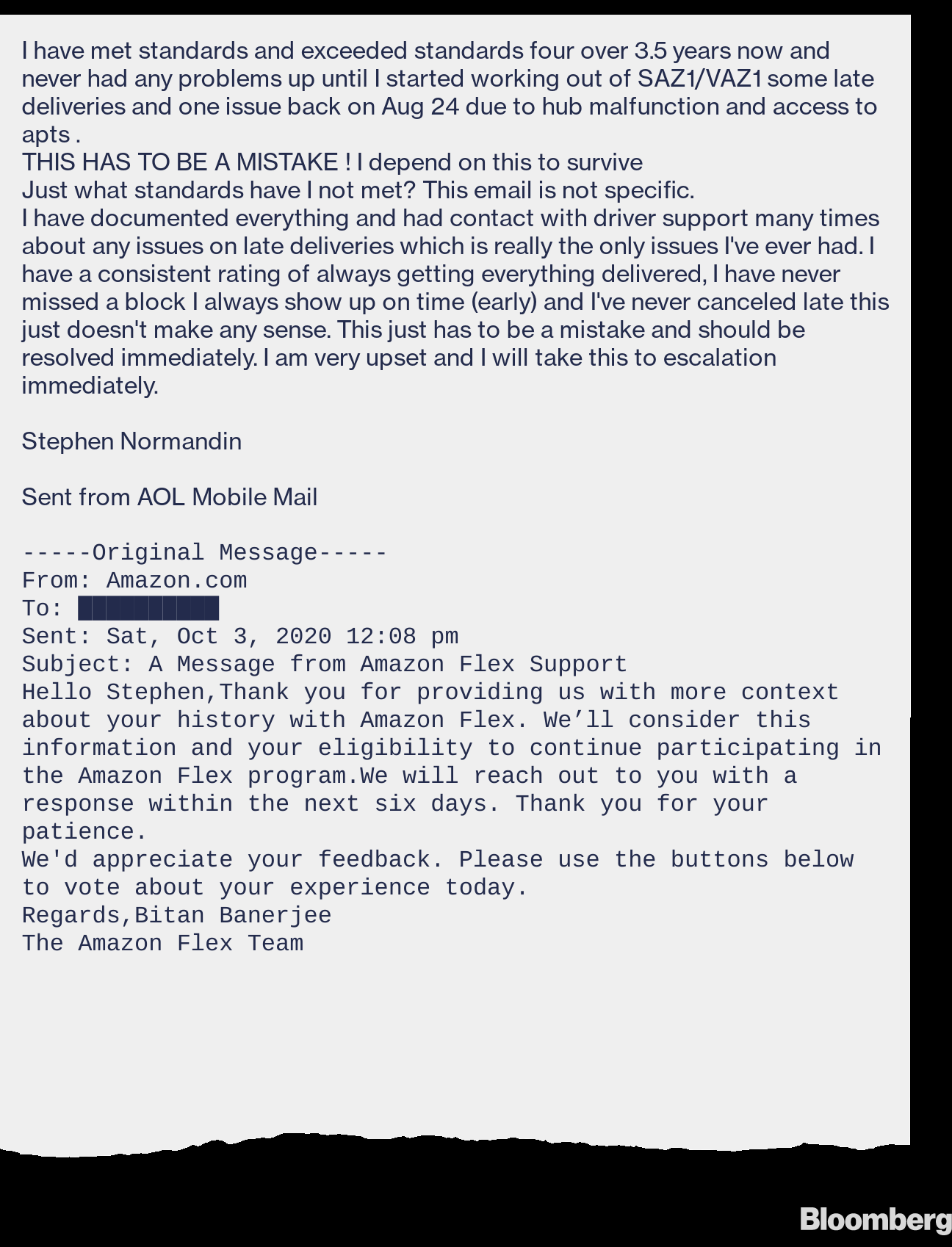

I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k. The FTC is sending payments totaling nearly 60 million to more than 140000 Amazon Flex drivers who had their tips withheld from them by Amazon between 2016 and. Unfortunately not everyone has had a wonderful experience with Amazon Flex and there are a fair amount of negative reviews.

The forms are also sent to the IRS so take note if youve made more than 600. Adjust your work not your life. With Amazon Flex Rewards you can earn cash back with the Amazon Flex.

Use A Gas Rewards Card. Beyond just mileage or car. Amazon Flex Reviews Online.

Gig Economy Masters Course. Increase Your Earnings. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do.

If this is your first year self-employed most Amazon Flex drivers are safe setting aside 25 to 30 of their pay. Knowing your tax write-offs can be a good way to keep that income in your pocket. Actual deliveries took two hours so 25 hrs total netting about 29hr.

In fact there are numerous ways Flex drivers can save money on fuel costs. It has 25 stars. You can make closer to 25 per hour by using a larger car which makes you eligible to deliver more packagesAnother option is to claim blocks during busy times which are marked in the.

After your first year you can pay based on your previous years. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. Initial drive took 30 minutes about 15 miles but it was chill and tax deductible.

In todays video I wanted to share with you guys how to file a tax return if you are self-employed. Block five December 23 - 4 hour block for. Amazon Flex quartly tax payments Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

Amazon Flex Tax Write Off Tiktok Search

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

What It S Like To Be An Amazon Flex Delivery Driver

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Frequently Asked Questions Us Amazon Flex

Amazon Flex App A Detailed Guide With Tutorial

Becoming Amazon Flex Driver How To Pros And Cons Salary

Amazon Flex Review Hours Pay Expenses Tips More

How To File Self Employment Taxes Step By Step Your Guide

Uber Drivers How To Calculate Your Taxes Using Turbotax

How Much Do Amazon Flex Drivers Make In 2022 Hyrecar

Becoming Amazon Flex Driver How To Pros And Cons Salary

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

How To File Amazon Flex 1099 Taxes The Easy Way

Does Amazon Flex Pay For Gas And Mileage In 2022

Amazon Flex Uk Calculating Your Taxes Youtube

Does Amazon Flex Pay For Gas Mileage Rules How To Save Money